What is Budgeting?

Budgeting is like creating a game plan for your money. It’s a strategy that helps you decide in advance how you’re going to spend and save your income so you can make the most out of it. Think of it like building a roadmap for your finances—you decide where your money should go, whether it’s for immediate needs, fun purchases, or future savings, rather than just letting it disappear without a trace!

Let’s get creative: Imagine you have a garden, and each dollar you earn is a seed. If you scatter your seeds randomly, some might grow, but others will get lost. But with a budget, you’re planting those seeds in the right spots, knowing exactly how many flowers (or in this case, dollars) you’ll have later.

A budget typically includes categories for things like:

Needs: Essential things like food, housing, and transportation. These are your must-haves.

Wants: Fun stuff like new clothes, dining out, or entertainment. It’s about enjoying life, but within limits.

Savings: Money set aside for future goals or unexpected situations, like a rainy day fund.

By sticking to your budget, you ensure you have enough to cover what matters most while also setting yourself up for bigger things in the future. Budgeting isn’t about restricting yourself—it's about giving yourself the freedom to enjoy your money while staying in control of your financial goals!

Why should you Budget?

Budgeting is important because it helps you manage your money effectively, no matter how much you have. By keeping track of your income and expenses, you can make sure you’re covering your essentials like rent, groceries, and bills, while also setting aside money for future needs.

It also helps prevent financial stress by making sure you don’t overspend or fall into debt. With a budget, you can prepare for unexpected expenses, like car repairs or medical bills, without having to scramble for cash.

Ultimately, budgeting helps you live within your means, plan for the future, and make the most of your money—whether you’re working toward small goals or simply trying to stay financially stable.

How should you Budget?

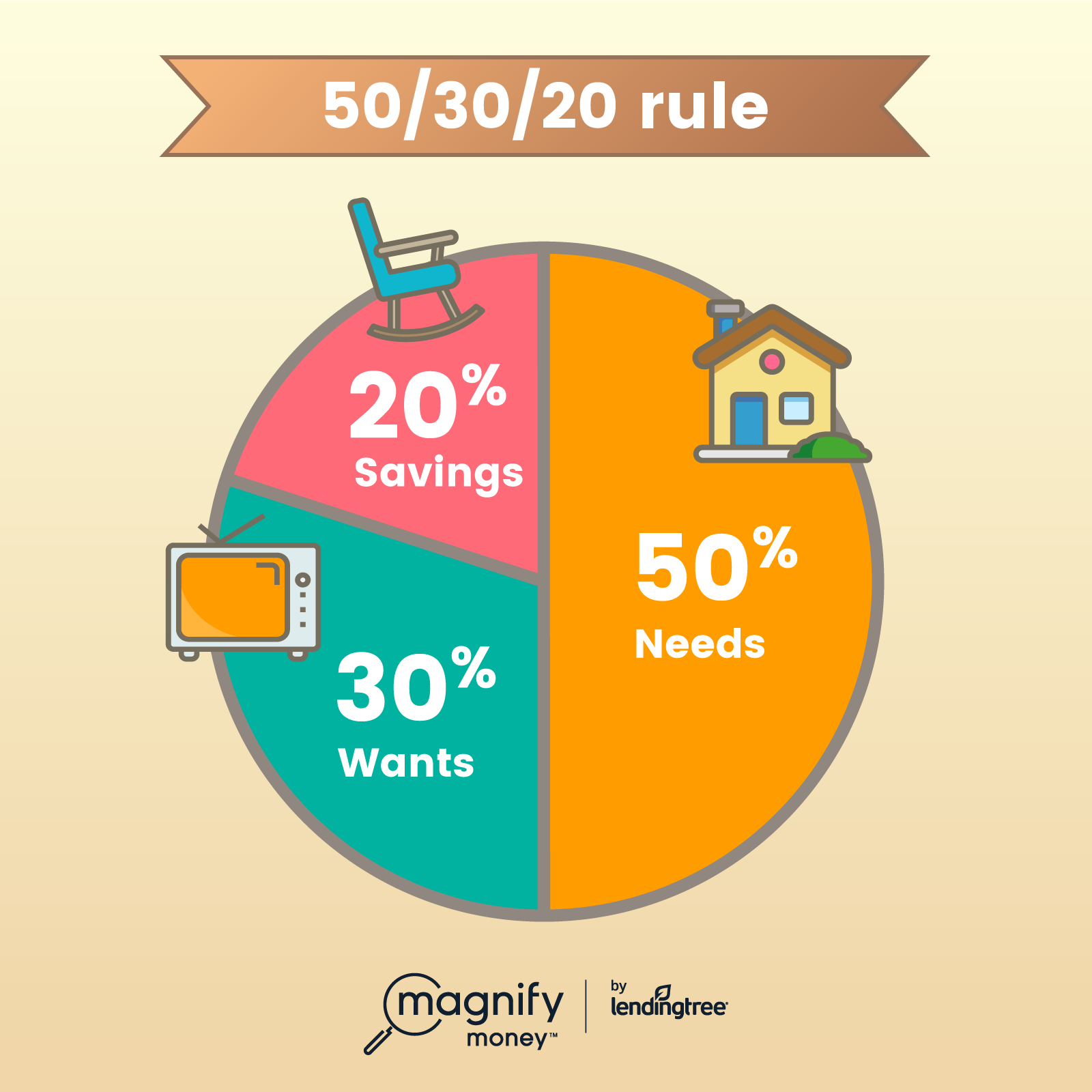

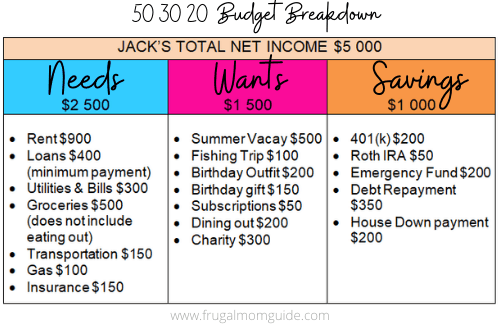

Most budget using the 50-30-20 rule. With this rule you should be spending 50 percent on your needs (bills, food, housing), 30 percent on your wants (iPhone, sneakers, toys), and 20 percent savings (retirement, car, Emergency fund). You can either use a budgeting app or a planner.

Budgeting Planners

Goal Planner

Goal planners help you save up for a specific goal. Let’s say you want to save up for a really cool 40 dollar game for every 10 dollars (1/4 of your goal) you saved you’d color in each section of the pig. Until your done with your goal!

Full Spending Planner

This allows you to see your full breakdown for the month/quarter/year. This planner in specific does a great job of showing the 50-30-20 rule in action.

Budgeting Apps

Mint app:

YNAB app:

Budgeting Game

Click this image to be directed to another tab for a fun budgeting simulation game!